Escape Velocity Simulator: Your Path to Financial Independence

A pragmatic, US-focused simulator born from a real conversation about burnout, secondaries, and knowing your personal escape velocity

Why I built this

I recently spoke with an employee at a wildly successful late‑stage private startup. He had come back from vacation about a month ago and was clearly burned out. We talked about the Figma IPO, some of the recent M&A deals, and insane AI engineer comps. He told me his company was going to offer to sell some equity but he probably wouldn’t sell any in that upcoming secondary. That sparked a longer conversation: you don’t have to stay on the rat race treadmill forever. What matters is understanding your personal escape velocity: the point where your capital can reliably fund your life.

Most people don’t approach this programmatically. They either hand‑wave, over‑optimize, or let emotion drive the decision. I built this simulator to make it factual. It helps you answer: at your current pace and risk profile, are you on track to reach escape velocity at 30? 40? 50? 60? And if not, what changes move the needle.

Incentives aren’t aligned

It’s rarely in a VC’s or employer’s interest to educate employees on their escape velocity. If you know your number and timeline, you might optimize for your own exit instead of perpetual grind. That’s fine. Your goals are not the same as your company’s cap table goals. This tool is meant to give you a clear, owner‑aligned view.

Reality check, not ideology

Quick disclaimer: Very few people hit escape velocity early. I am well aware this is a first‑world problem. Nonetheless, we can (and should) acknowledge that but still be able to talk about it without shame. “Retire early” does not have to mean not working: it can mean doing work that pays nothing (nonprofits, shelters, caretaking, research, art). Escape velocity is optionality.

US‑centric assumptions, not advice

This simulator uses US tax assumptions and mainstream parameterization of inflation, returns, and volatility. It’s a framework for scenario planning, not financial advice. See the technical notes and disclaimer below for specifics. This is not your run of the mill TikTok influencer "how to retire early" content. I have no online course to sell, no affiliate links, no ads, no sponsors, no nothing. This is a tool to help you think through an important financial question.

What is the escape velocity simulator?

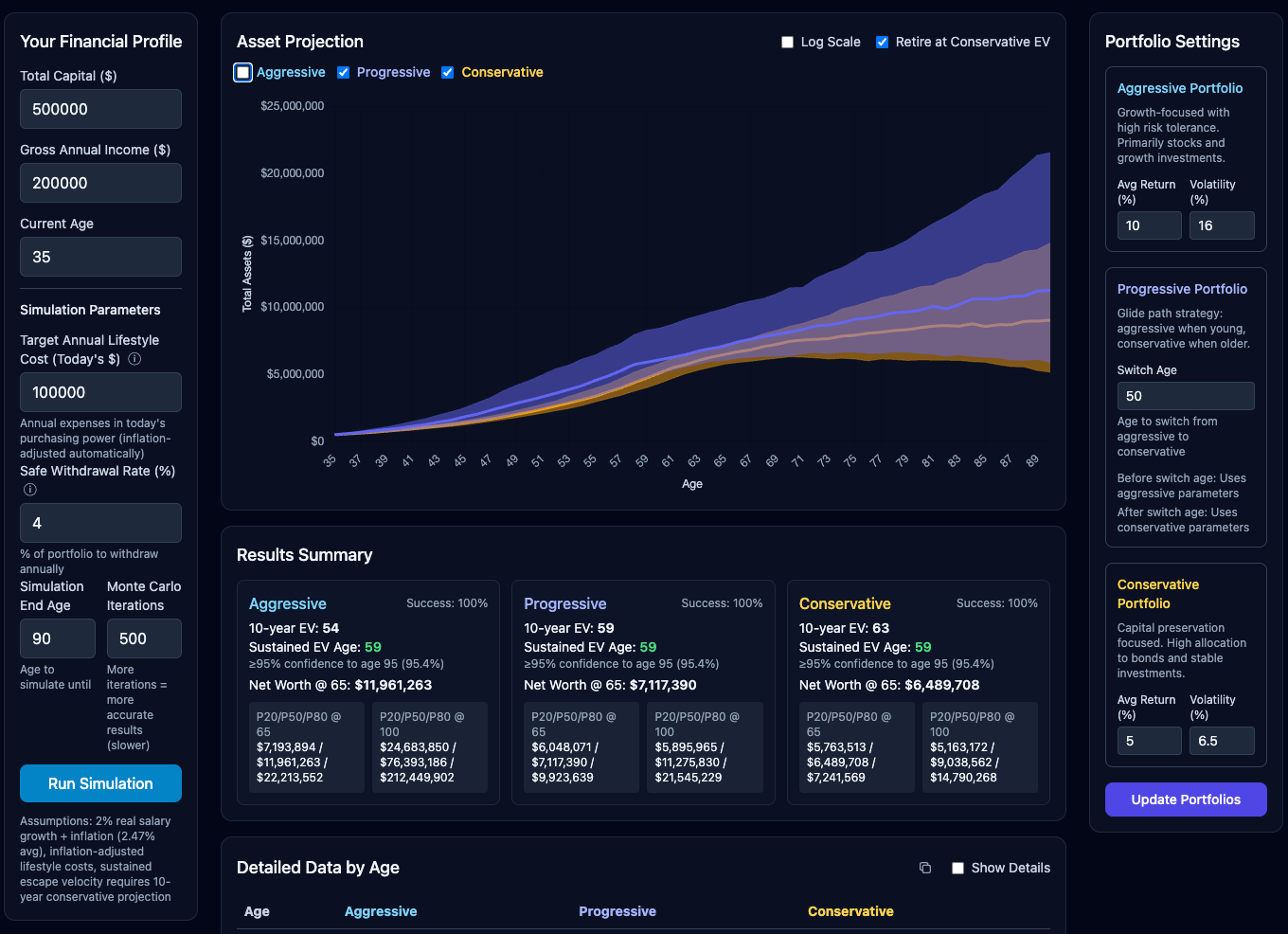

The Escape Velocity Simulator is a quick financial simulation tool that helps you understand when you can achieve financial independence (FI) and retire early. Unlike simple retirement calculators, this tool uses Monte Carlo simulations to model different investment strategies and market scenarios, giving you a more realistic picture of your path to financial freedom.

Why use this tool?

Realistic planning

Unlike simple calculators, this accounts for market volatility, inflation, taxes, and real-world uncertainties. The Monte Carlo approach runs hundreds of scenarios to show you the range of possible outcomes, not just a single optimistic projection.

Multiple investment strategies

Compare three distinct approaches to find what works for your risk tolerance:

- Aggressive: High-growth, high-volatility portfolio for maximizing returns

- Progressive: Glide path strategy that automatically reduces risk as you age

- Conservative: Capital preservation focused with lower volatility

Two types of escape velocity

The simulator calculates both:

- 10-Year Escape Velocity: The earliest age when your portfolio can sustain your lifestyle for 10 years with 70% confidence

- Sustained Escape Velocity: The earliest age with at least 95% confidence your portfolio will last until age 95

Visual insights

See your wealth trajectory with confidence bands showing best-case, worst-case, and realistic scenarios. Toggle between linear and logarithmic scales to better understand long-term growth patterns.

How It Works

The math behind the simulation

The simulator uses several key financial models:

-

Stochastic Inflation: Models inflation as a random variable with 2.47% average and 1.24% standard deviation (based on historical data)

-

Tax Calculations: Incorporates 2024 US federal tax brackets, Social Security (capped at $168,600), Medicare, and estimated state taxes

-

Market Returns: Normal distribution based on historical data:

- Aggressive: 10% mean return, 16% volatility

- Conservative: 5% mean return, 6.5% volatility

- Progressive: Switches from aggressive to conservative at age 50

-

Monte Carlo Simulation: Runs 100-10,000 iterations to generate probability distributions of outcomes

Key concepts explained

Safe Withdrawal Rate: Based on the Trinity Study, the default 4% withdrawal rate has historically had a 95%+ success rate over 30-year retirement periods.

Conservative Escape Velocity: The simulator recommends using the later of the two EV ages as your retirement target, ensuring maximum financial security.

Savings Rate Calculation: Automatically calculated based on your after-tax income minus lifestyle costs. The simulator handles cases where lifestyle exceeds income by drawing from capital.

How to use the simulator

- Enter Your Financial Profile: Start with your current total capital, gross annual income, and age

- Set Your Goals: Define your target annual lifestyle cost (in today's dollars) and safe withdrawal rate

- Customize Portfolios (Optional): Adjust expected returns and volatility for each strategy

- Run Simulation & Analyze: Click "Run Simulation" to see your results and explore different scenarios

Model assumptions

- Inflation: Stochastic model with 2.47% average and 1.24% standard deviation

- Salary Growth: 2% real growth above inflation annually

- Taxes: 2024 US federal brackets, Social Security, Medicare, and estimated state taxes

- Market Returns: Normal distribution based on historical data for each strategy

- Lifestyle Costs: Inflation-adjusted over time to maintain purchasing power

- Retirement: No further income, only portfolio withdrawals and investment returns

Pro tips

- Start conservative: Use the "Conservative EV" age as your primary target

- Compare scenarios: Toggle between retirement scenarios to see impact on wealth

- Use log scale: Better visualize long-term growth patterns

- Export data: Use CSV export for detailed analysis or sharing with advisors

Launch the simulator

🚀 Open simulator in full screen →Important disclaimer

This simulator is for educational and simulation purposes only and reflects US‑specific tax and policy assumptions. It should not be considered professional financial advice. The projections are based on historical data and assumptions that may not reflect future market conditions. Always consult with qualified financial advisors before making significant financial decisions.

Technical notes

The simulator runs entirely in your browser using JavaScript Web Workers for performance. No personal data is transmitted to any server. All calculations are performed locally on your device.

Recent updates (August 2025)

- Fixed federal tax bracket calculations for accurate tax estimates

- Updated Social Security wage base to 2024 limit ($168,600)

- Improved 10-year escape velocity with probabilistic assessment (100 Monte Carlo runs)

- Enhanced deficit tracking for scenarios where expenses exceed income

- Added proper percentile calculations with linear interpolation

Questions or feedback?

If you have questions about the simulator or suggestions for improvements, please reach out.